(For the tax geeks among us, these transactions are summarized according to Exception 1 & 2 in the IRS’s instructions for Form 8949) The downloaded transactions will further be summarized to ensure that they are easy to deal with and easy to file.

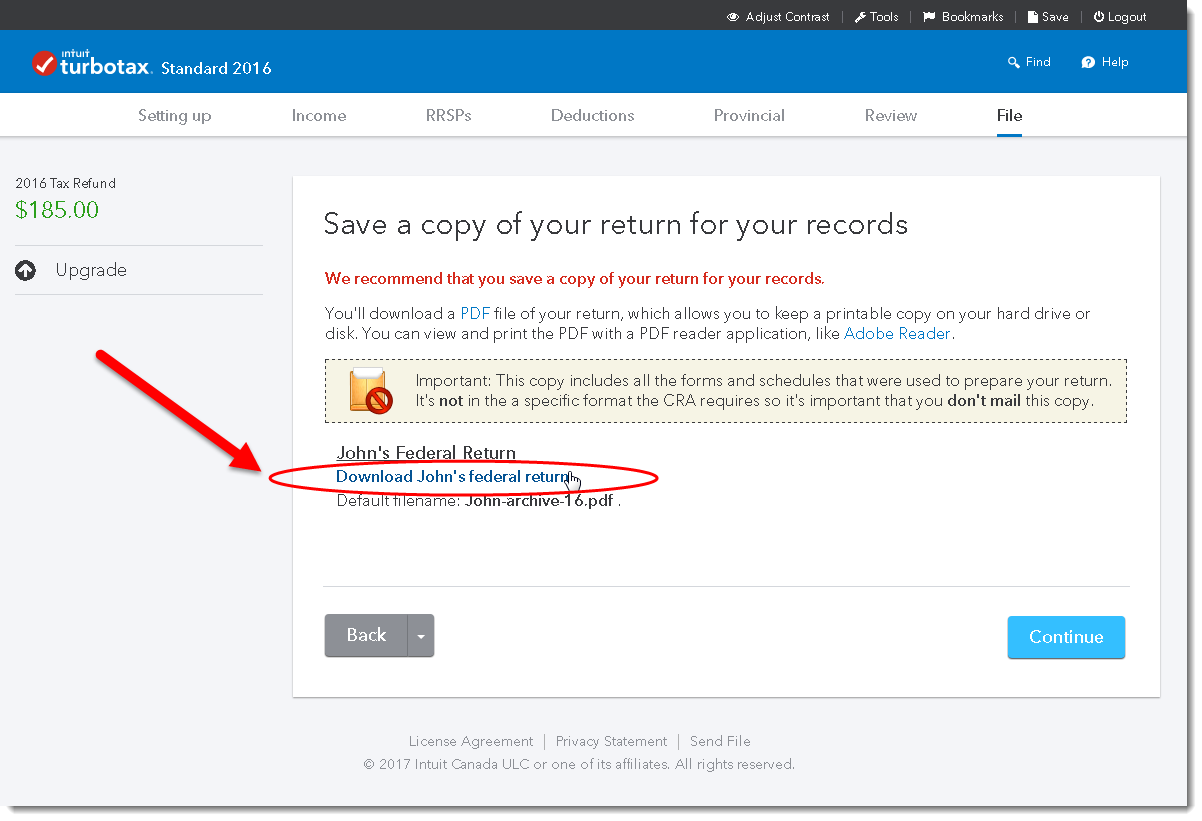

How do i open 2015 turbo tax files in turbo tax 2016 download#

If you choose to use TurboTax for your filing needs, all you need to do is enter your Wealthfront credentials directly, and TurboTax will automatically download the relevant data from your Wealthfront accounts. This year, we’re proud to announce that we have deepened our integration with TurboTax to automatically import and roll up all your Tax-Loss Harvesting and Stock-level Tax-Loss Harvesting transactions into a simple set of entries for easy tax filing. Of course, you can only claim the benefit of these losses if you file them correctly on your tax return, and for some people, entering investment transactions on their tax forms can seem daunting and time consuming. Fortunately, these moves came before the increased volatility we saw in global markets in the second half of the year, which meant many more opportunities to harvest losses for our clients. In addition, we began to offer tax-loss harvesting to all our clients, regardless of their account balance. This past year Wealthfront lowered the minimum account balance required to take advantage of Stock-level Tax-Loss Harvesting to $100,000.

Automated TurboTax Integration for Stock-level Tax-Loss Harvestingįrom a tax perspective, 2015 was an unprecedented year of tax savings for Wealthfront clients who took advantage of our Daily Tax-Loss Harvesting and Stock-level Tax-Loss Harvesting services.

This year, we’re proud to say we have worked hard to make it even easier to file your 2015 taxes. At Wealthfront, we pride ourselves on our efforts to both minimize our clients’ taxes and make them as simple as possible to file. Not only can investment taxes be confusing and difficult to file, but at most traditional brokerages, you only realize a hefty tax bill is due when you receive your 1099 forms. For too many investors, tax season is a time filled with unwelcomed surprises.

0 kommentar(er)

0 kommentar(er)